Back in the 1990s when professional wrestling was very big in the western world, there were mainly three companies that ruled the industry. Ted Turner's WCW, Vince McMahon's WWE (WWE) and Paul Heyman's ECW competed for the dominance in professional wrestling. At some point, WCW came close to driving its competition out of business, but Vince McMahon's business skills helped WWE turnaround and beat the competition. Later on WWE bought WCW and ECW and became the dominant company in the world of professional wrestling. For the last 10 years, WWE has been enjoying its dominant position with little to no serious competition, and many people see that the company has no more room to grow. In this article, we will look at whether the company has more growth left in it or not. We will also examine where the company's growth can possibly come from.

WWE's Business Model

WWE earns money from a large variety of sources including but not limited to the live televised shows, ticketed events such as house shows, merchandise sales (such as t-shirts and DVDs), pay per view shows, sponsorships, magazine subscriptions, the company's own on-demand TV station and video games. The company plans to see revenue growth through introduction of new products in addition to expanding its fan base to new countries.

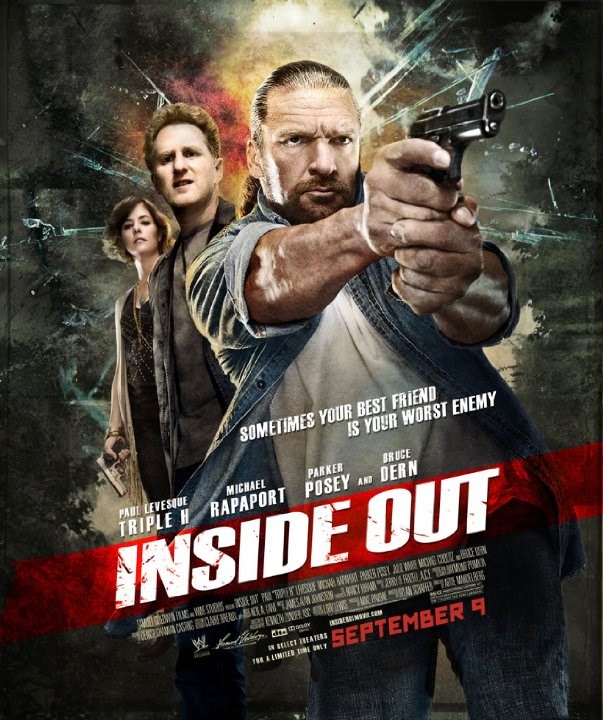

In addition, the company produces and distributes movies using its current roster of superstars under the WWE Studios brand. So far, WWE Studios has produced movies such as The Marine featuring John Cena, See No Evil featuring Kane and The Condemned featuring Stone Cold Steve Austin. While these movies didn't earn much money in the box office, they were very profitable for the company when they were introduced in DVD.

Recent Growth Trends

In the last quarter, the company's PPV viewership was up by 13% and home video viewership was up by 16%. WWE keeps its fans engaged by interacting with them using social media and this has been working very well for the company so far. The company's mobile application was downloaded by 2.4 million people within the first 90 days of its launching. The average attendance of ticketed events was up by 6% domestically and it was up by 17% internationally. Now, in average, each WWE event draws 5,200 fans in the arena. This is up from an average attendance of 4,900 fans last year. The company's TV show continues to be one of the most watched shows in the cable TV. In addition, the company airs its flagship program Monday Night Raw on Hulu Plus for paid members, which generates extra income for WWE.

The company is seeking growth on TV by expanding its show coverage. Only a few years ago, the WWE had two shows (Raw and Smackdown) totaling four hours of cable TV exposure. Now Raw lasts three hours, Smackdown lasts two hours, and the company has several additional shows going on as well. For example, WWE Main Event and Saturday Morning Slam both have one-hour slots. In the last couple quarters alone, the company's weekly cable TV exposure increased by two and half hours.

Financials

In the last quarter, WWE's revenue was down by 4% compared to the same quarter in 2011. The revenue from live events was up from $26.6 million to $27.3 million. The revenue from pay per views was up from $15.8 million to $16.3 million. The digital media revenue was up from $6.9 million to $7.5 million. The TV revenue was flat at $34 million. On the other hand, the company's licensing revenue was down from $9 million to $7.1 million. This is because there were two WWE video games in 2011 but only one WWE video game in 2012. The second video game was cancelled before it went in production. Also, WWE's home video revenue was down from $8.3 million to $6.4 million, mostly because of the promotions and discounts offered by the company in order to clean its inventory.

Out of the seven business segments, six were profitable and one wasn't. WWE Studios had a loss of $1 million in the quarter; however, the company is very hopeful about some of the future products that will come out of the WWE Studios. WWE's profit margin for the quarter was 41%, slightly below %45 for the year 2011. The average sale price for a WWE home video was down from $13.10 to $11.01.

Where Will the Future Growth Come From?

In the near future the company will launch its own TV channel, WWE Network. This channel will be available through most if not all cable TV providers. The users wanting to watch this channel will have to purchase it separately, which will bring WWE additional revenues. A lot of new opportunities will come to WWE with this new TV channel as its weekly TV content will go from 6 hours per week to 168 hours per week. WWE enjoys a giant library of wrestling content and the company will take advantage of the library as much as it can. Considering how WWE's biggest revenue driver is its TV shows, this should be great for the company.

Some of WWE's content is available on Hulu Plus and some other content is available on Netflix (NFLX). In the future, the company can make more of its content available in these websites for additional growth. The good news is that the company doesn't need to spend any additional money in order to make its content available in online movie rental websites, because these companies do all the work. Introducing more content available online will also help with improving WWE's profit margins.

WWE will continue to utilize the social media in order to improve its public image as well as its revenues. As of last quarter, WWE has more than 80 million followers on Facebook and nearly 40 million followers on Twitter. The number of WWE's followers in the social networks has nearly doubled in the last year. In fact, WWE has more followers on Facebook than the NHL and the NFL, and the only sports organization that attracted more followers than WWE is the NBA. Having a lot of followers in social networks may not translate into revenue directly, but this will help the company get better TV deals in addition to better sponsorships.

Outside of the USA, WWE has a huge following which keeps growing. The company's international events attract an average attendance of 8,400 fans and the average ticket price is $98. Both numbers are up by double digit percentages in the last year, which is great for the company. As the company conducts more international tours, its exposure and revenues outside of the USA will increase exponentially. In the near future, the number of countries that will receive live WWE shows and PPVs is likely to increase as the company prepares to launch its own network.

The company will have to rely on bigger superstars such as The Rock (Dwayne Johnson) or Hulk Hogan in order to rake in large profits in its WWE Studios segment. So far, the movies released by WWE have been mostly profitable, but the profits haven't been much to write home about. WWE tends to use its current superstars in movies, but it wouldn't hurt to use some Hollywood actors in order to boost interest in these movies.

Conclusion

WWE is a decent company to own for those who are interested in adding a small cap to their portfolio. WWE has some work to do in certain areas, but its growth story is still intact and there are many opportunities in front of the company in the medium term. Besides, the stock pays regular dividends yielding around 6%, which means the company actually pays investors to wait for more of its success. As the company keeps increasing its portfolio of products, there is no reason why it shouldn't keep growing. On a positive note, the company's Chairman Vince McMahon has been in the business of professional wrestling all his life, and he knows this business more than anyone in the world.

source: seekingalpha.com

Longest Running Triple H Fansite

Since 2006

Since 2006

0 comments:

Post a Comment

Your comment awaits moderator approval. Comments that are abusive, spam, off-topic, use excessive foul language, or include ad hominem attacks will be deleted.